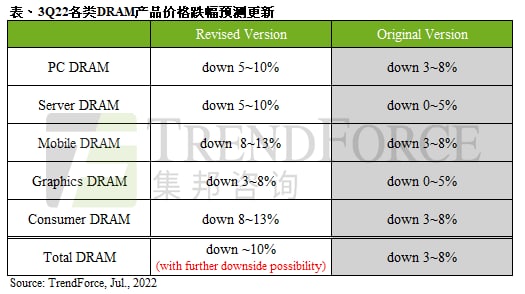

According to the latest research by TrendForce, despite the rapid weakening of overall consumer demand in the first half of this year, the previous strong bargaining power of DRAM original manufacturers did not show signs of price cuts to sell, causing inventory pressure to gradually shift from the buyer to the seller side. In the second half of the year, when the demand outlook for the peak season is uncertain, some DRAM suppliers have started to have clearer intentions to reduce prices, especially in the server sector where demand is relatively robust in order to de-stabilize inventory pressure, which will cause DRAM prices to expand from the original 3-8% quarterly decline to nearly 10% in the third quarter, and if this subsequently triggers a competitive price reduction by the original manufacturers, the decline may exceed 10%.

PC OEMs are still continuously revising their shipment outlooks, and with DRAM inventory levels averaging more than two months, there is no urgent demand for purchases unless there is a great price incentive. At the same time, PC DRAM price decline will be revised to 5-10% in Q3 due to the continued transition to 1Z/1alpha advanced process and the limited penetration of DDR5 due to its high price, and the inability to effectively converge DDR4 output.

The current server DRAM inventory in the hands of customers is about 7~8 weeks, and buyers believe that there is still room for DRAM prices to go down by virtue of the increased inventory pressure carried by the seller, and are willing to discuss the possibility of tying volume agreements if the original manufacturer is willing to provide attractive offers. With the aggressive transition to advanced processes and the continued weakness of consumer terminals, server DRAM has become the only effective sales market. Therefore, Korean manufacturers are the first to release more than 5% quarterly decline to discuss the willingness to expand the third quarter server DRAM decline to 5 ~ 10%.

By the impact of the general economic downturn, smartphone production targets continue to be revised downward, the brand factory is also more pessimistic about the future outlook, so the negative attitude towards material preparation. But due to the original factory advanced process transfer to help, the third quarter mobile DRAM output is still increasing, the supplier pressure is also rising. This will prompt the seller's willingness to raise the price, in the case of polarization of supply and demand differences, the quarter mobile DRAM price decline is forecasted to expand to 8~13%.

The demand for graphics DRAM procurement is weakened by the impact of inflation lowering demand for consumer products and sluggish cryptocurrency. At the same time, graphics DRAM capacity is not as easy to switch as standard DRAM (Commodity DRAM), although demand has weakened, but suppliers are difficult to quickly adjust output, so also facing gradually pile up the pressure of high inventory, the third quarter graphics DRAM prices will be revised to 3 ~ 8% quarterly decline.

As TV shipments have been the first to fall, while the network, industrial control and other related demand also appeared signs of weakness. DDR3 prices are currently at a relatively high point, the price of the future to make up for the larger space; DDR4-related applications pulling the weak momentum, also does not rule out the possibility of expanding the decline. In addition to the advanced process shift into the output expansion, the second half of the year, there are still land-based factories and Taiwan factories to open new production capacity, it is estimated that this quarter consumer DRAM prices will fall deeper to 8 ~ 13%.