On June 30, Micron Technology, a major storage manufacturer, announced its fiscal year 2022 third quarter earnings.

DRAM and NAND grow in tandem

Micron achieved revenue of approximately $8.64 billion for the quarter, up 16.4% year-over-year; net income attributable to common shareholders of the parent company was $2.626 billion, up 51.35% year-over-year.

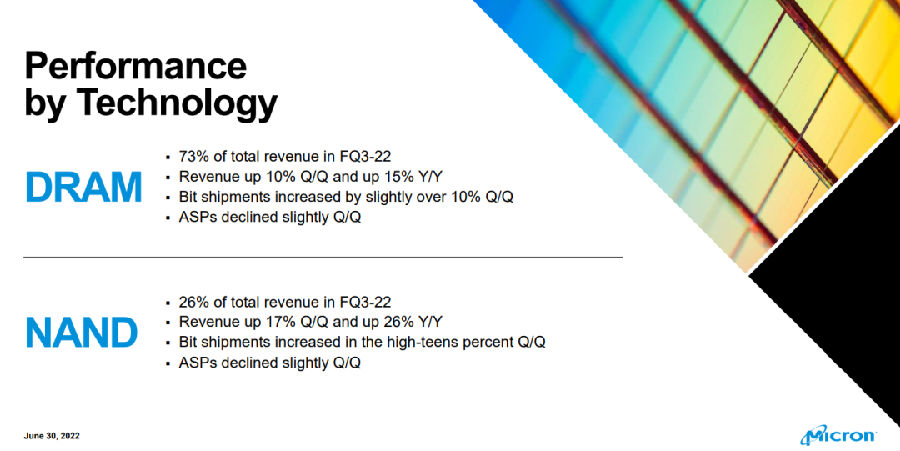

Micron's DRAM business accounted for 73 percent of revenue in the quarter, with revenue up 10 percent sequentially and 15 percent year-over-year; NAND revenue accounted for 26 percent, with revenue up 17 percent sequentially and 26 percent year-over-year.

By segment, Micron's Computer and Networking Business Unit (CNBU) recorded revenue of $3.895 billion, up 18% year-over-year and 13% sequentially; Mobile Business Unit (MBU) achieved $1.967 billion, down 2% year-over-year and up 5% sequentially; Storage Business Unit (SBU) achieved $1.341 billion, up 33% year-over-year and 15% sequentially; Embedded Products Business Unit (EBU) recorded $1.435 billion, up 30 percent year-over-year and 12 percent sequentially.

Pessimistic forecast for the fourth fiscal quarter?

"Micron delivered record revenue in the fiscal third quarter due to our team's excellent execution across technology, product and manufacturing," said Sanjay Mehrotra, Micron's chief executive officer. "Recently, the industry demand environment has weakened and we are taking action to moderate supply growth in fiscal 2023. We are confident in the long-term demand for storage and are well positioned to deliver strong cross-cycle financial results."

Micron has made a pessimistic expectation for the next fiscal quarter, driven by factors such as weak demand in consumer electronics markets such as cell phones and personal computers. The company expects fiscal fourth-quarter revenue of $7.2 billion, which is well below analysts' forecasts of $9.14 billion.

Sanjay Mehrotra said on the earnings call that smartphone sales are expected to decline about 5 percent from last year, while personal computer sales could fall 10 percent from last year, and Micron is adjusting production growth to accommodate weakening demand.

Latest Technology Progress at a Glance

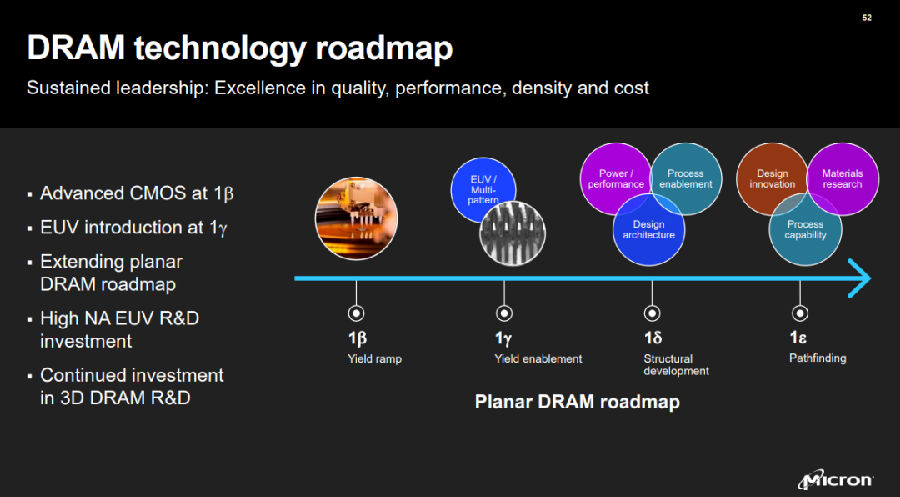

Micron DRAM and NAND Flash technologies currently maintain a leading position in the market. Micron said the company's 1α DRAM products continue to grow and the latest DRAM technology path - 1β DRAM - is expected to enter production by the end of this year.

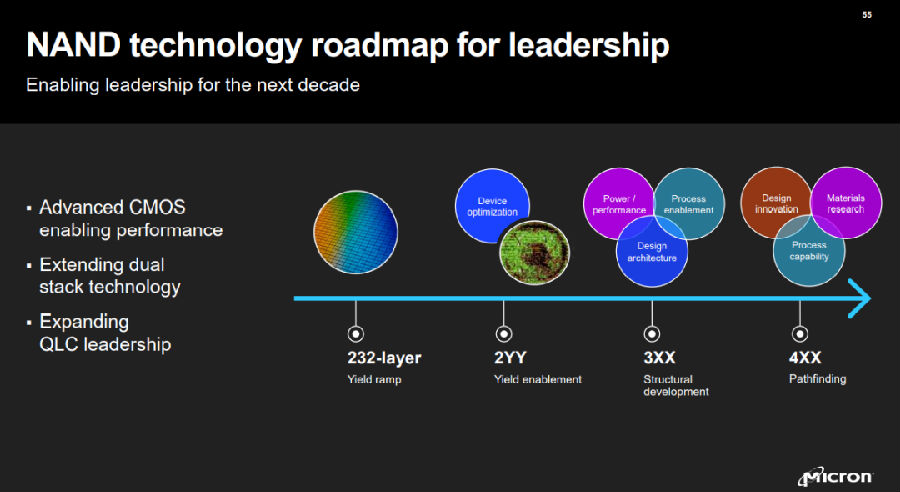

For NAND Flash, Micron's 176-layer node product sales continue to grow, and the 232-layer NAND Flash product has now made significant progress and is expected to be accelerated to production by the end of 2022.

A little earlier, Micron showed its DRAM and NAND future technology roadmap to the public, stating that it will continue to focus on 1β, 1γ and 1δ processes in the DRAM field, with Micron planning to launch 1β DRAM products by the end of 2022 and planning to start producing 1β process DRAM products using its Hiroshima plant in Japan in the second half of this year. In addition, the company said it will introduce EUV technology in the 1γ DRAM process.

For NAND Flash, after 176 layers of NAND flash, Micron process nodes are 232 layers, 2YY, 3XX and 4XX in that order.